Are You Aligned With the Right Type of Financial Professional?

The benefits of working with a financial professional are well-documented, as study after study shows that people who entrust their finances to some type of adviser ultimately are better-positioned to fulfill their goals and meet their obligations than those who don’t.

The benefits of working with a financial professional are well-documented, as study after study shows that people who entrust their finances to some type of adviser ultimately are better-positioned to fulfill their goals and meet their obligations than those who don’t.

To fully reap those benefits, however, it’s important for a person to work with the right kind of financial professional — one who’s best-equipped to deliver the type of guidance and expertise appropriate to the person’s needs, circumstances and goals, and one whom that person trusts and is comfortable with in the context of a working relationship.

This could well be the person in whom you trust your financial health for years, even decades, the person you’re likely to lean on for troubleshooting, problem-solving, as a sounding board and a strategist. And given what’s at stake — your money, your family’s financial well-being, your future — you better be sure that financial professional is the right one for you. Below are some suggestions for verifying that you and your current adviser are a good match, and if not, finding one who is:

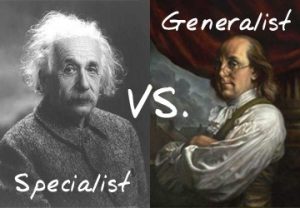

Decide whether it’s best to work with a professional who’s a generalized of one who’s a specialist. From generalists whose expertise lies in “big picture” financial planning to specialists with a narrower focus, the term “adviser” applies to a wide range of financial and insurance professionals.

If you’re a hands-off type who prefers to cede responsibility for quarterbacking your financial life to a professional, or if you lack the wherewithal to manage your own finances, perhaps your best option is to align with a generalist — someone like a Certified Financial Planner™ who has the training and experience to handle a broad range of issues, from investments to insurance to retirement planning to debt-management, and one who can pull all these pieces together into a comprehensive, coherent plan.

On the other hand, if you’re more of a hands-on type who has the know-how, the time and the desire to fulfill at least some of these responsibilities yourself, and/or if you have narrow, very specific areas where you could benefit from professional guidance, then maybe it’s best to align with a specialist who focuses on a particular area, be it investment management, insurance, retirement income, estate planning, etc.

Specialists also cater to certain segments of the population. Some focus on financial planning for women, some on divorced or divorcing clients, some on planning for members of the military, and some on helping clients in a specific stage in life, such as retirees/seniors or 20- and 30-somethings.

What’s more, if your finances are more complex, it may make sense to use multiple advisers: a generalist to quarterback multiple specialists, for example, or multiple specialists quarterbacked by you.

The bottom line: You need a financial quarterback who sees the big picture and can orchestrate all the moving parts, whether it’s you or a financial professional you hire, says Katheryn B. Hauer, a Certified Financial Planner™ with Wilson David Investment Advisers in Aiken, SC, and author of the book, Financial Advice for Blue Collar America. Otherwise, you run the risk of specialists making recommendations/decisions about your finances without necessarily knowing how those recommendations/decisions jibe with other aspects of your financial life. “You can give an investment adviser money to invest, but they’re not necessarily going to know about, or ask you about, a debt issue, for example. Maybe the smart big-picture decision is to use that money to pay down debt instead of investing it. Without seeing the big picture, the specialist might not be able to prevent you from making a financial mistake.”

Understand what’s behind an adviser’s professional certifications and designations. Many financial professionals, whether they are generalists or specialists, carry professional credentials that speak to their education, training, licensing and/or certification. But the sheer variety of credentials available to financial professionals make it hard to know which deserve more weight than the next and which apply to your needs as a client.

Generally speaking, when you see an acronym behind an adviser’s name, such as CFP®, it means they earned that designation from an organization through extra professional course work in a specific area of financial or insurance planning. To earn a CFP® designation, for example, an adviser has to complete a series of courses offered through the College of Financial Planning, then pass an exam. They also must earn continuing education credits to maintain their CFP® designation.

Do you need to work with an adviser with a specific designation or license? Not necessarily. But according to Hauer, credentials are “hugely important. A serious financial professional will make the effort to get the appropriate professional credentials to corroborate their assertions and recommendations. I’d be wary of an adviser who has no professional credentials.”

All it takes is a few minutes of online research to learn how rigorous or easy the program to earn a designation or license is, what kind of continuing education is required to maintain it, the kind of expertise that earning a designation confers, and the nature of the organization providing the designation or license. The letsmakeaplan.org website is a good way to get background on what the CFP® designation entails, for example.

Find out whether the adviser is required to protect your best interests. Some advisers are obligated, by law and/or under the terms of their particular professional designation, to always put the best interests of you, the client, first, above their own business interests and those of their firm or the company (or companies) whose products and services they represent. These advisers must adhere to what’s called a fiduciary standard. Among the licenses, designations and certifications that come with a fiduciary standard are a Certified Financial Planner™, a registered investment adviser (RIA), an Accredited Investment Fiduciary® and a Certified Financial Analyst (CFA).

As a consumer, it’s vital to understand the difference between advisers who must adhere to a fiduciary standard and advisers, such as stockbrokers and insurance agents, who follow a less stringent set of rules known as the suitability standard. The suitability standard requires the adviser to recommend products that are “suitable” to the client — that is, that the recommended security or product fit the client’s investing objectives, needs and circumstances. Unlike with fiduciaries, the allegiances of advisers who operate under a suitability standard ultimately lie first with their firm and/or the company whose products they’re recommending and selling. So while they’re required to recommend “suitable” products to their clients, the products they recommend might not be the most suitable in light of factors such as fees, commissions, etc. Just because a product is suitable doesn’t mean it’s the best fit for the consumer.

So if you want to be clear about where an adviser’s interests lie, be upfront and ask them, do they operate under a fiduciary standard or a under a suitability standard. If you want no ambiguity in where your adviser’s allegiances lie and a greater assurance that their interests align with yours, working with a fiduciary may be the best route.

Verify an adviser’s qualifications, experience and compliance record. You want an adviser who is what they say they are, preferably with an exemplary professional record. To find out if an adviser has had any complaints, transgressions, judgments or legal actions against them, it’s worth a quick visit to the website of the relevant regulatory agency with purview over the adviser. For example, for detailed background on financial professionals who have earned the CFP® designation, check out http://letsmakeaplan.org/choose-a-cfp-professional/verify-a-cfp-professional. If the adviser you’re researching is a registered securities broker, check out the U.S. Securities and Exchange Commission site at www.sec.gov/investor/brokers.htm. For info about the adviser’s business practices, fees, conflicts of interest and disciplinary information, visit www.adviserinfo.sec.gov/IAPD/Content/IapdMain/iapd_SiteMap.aspx. The regulatory body FINRA offers access to a database called BrokerCheck (www.finra.org/Investors/ToolsCalculators/BrokerCheck) that can tell you whether brokers are properly licensed in your state and if they have been the subject of client complaints and/or disciplinary action.

Look for good chemistry. The “soft” side of the adviser-client relationship matters! As a client, it’s important not only to be confident in your adviser’s professional skills, experience and credentials, but also to trust them, be comfortable with their approach and have a good rapport with them.

Determining whether a financial professional is the right match for you is ultimately “about how they combine their knowledge, credentials, and experience, both personal and professional,” says Christine Haviaris, CFP®, who heads TTR Wealth Partners in Pearl River, NY. “Add to that their philosophy, sensibility and way of working with clients, and it's easy to see that every adviser is as unique as every client. So finding the best match is about much more than just finding the right designation!”